Weak passwords can compromise the best security tools and controls. With a never-ending list of applications and services that users and consumers access, people may have dozens of passwords to maintain at any given time. Often, the temptation to use familiar terms such as pet names, favorite teams or the names of children or friends can cause risk since much of those details can be discovered by a simple examination of social media.

Creating strong passwords offers greater security for minimal effort. Weak passwords can compromise the best security tools and controls. With a never-ending list of applications and services that users and consumers access, people may have dozens of passwords to maintain at any given time. Often, the temptation to use familiar terms such as pet names, favorite teams or the names of children or friends can

cause risk since much of those details can be discovered by a simple examination of social media.

Under Lock and Key

You can buy a small padlock for less than a dollar—but you should not count on it to protect anything of value. A thief could probably pick a cheap lock without much effort, or simply break it. And yet, many people use similarly flimsy passwords to “lock up” their most valuable assets, including money and confidential information. Fortunately, everyone can learn how to make and manage stronger passwords. It is an easy way to strengthen security both at work and at home.

What Makes a Password ‘Strong’?

Let’s say you need to create a new password that’s at least 12 characters long, and includes numerals, symbols, and upper- and lowercase letters. You think of a word you can remember, capitalize the first

letter, add a digit, and end with an exclamation point. The result: Strawberry1!

Unfortunately, hackers have sophisticated password-breaking tools that can easily defeat passwords based on dictionary words (like “strawberry”) and common patterns, such as capitalizing the first letter.

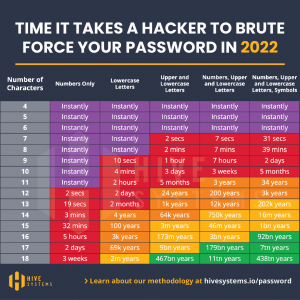

Increasing a password’s complexity, randomness, and length can make it more resistant to hackers’ tools. For example, an eight-character password could be guessed by an attacker in less than a day, but a 12-character password would take two weeks. A 20-character password would take 21 centuries. You can learn more about creating strong passwords in your organization’s security awareness training. Your organization may also have guidelines or a password policy in place.

Why Uniqueness Matters

Many people reuse passwords across multiple accounts, and attackers take advantage of this risky behavior. If an attacker obtains one password—even a strong one—they can often use it to access other valuable accounts.

Here is a real-life example: Ten years ago, Alice joined an online gardening forum. She also created an online payment account and used the same password. She soon forgot about the gardening forum, but someone accessed her payments account years later and stole a large sum of money.

Alice did not realize the gardening forum had been hacked, and that users’ login credentials had been

leaked online. An attacker probably tried reusing Alice’s leaked password on popular sites—and

eventually got lucky.

Guarding Your Passwords & PINS. Passwords and PINS protect sensitive data and it's critical to keep them safe. Try these best practices to stay protected.

1. Do not write them down – Many make the mistake of writing passwords on post-it notes and

leaving them in plain sight. Even if you hide your password, someone could still find it. Similarly, do

not store your login information in a file on your computer, even if you encrypt that file.

2. Do not share passwords – You cannot be sure someone else will keep your credentials safe. At

work, you could be held responsible for anything that happens when someone is logged in as you.

3. Do not save login details in your browser – Some browsers store this information in unsafe

ways, and another person could access your accounts if they get your device.

4. Use a password manager – These tools can securely store and manage your passwords and

generate strong new passwords. Some can also alert you if a password may have been

compromised.

5. Never reuse passwords – Create a unique, strong password for each account or device. This

way, a single hacked account does not endanger other accounts.

6. Create complex, long passwords – Passwords based on dictionary words, pets’ names, or other

personal information can be guessed by attackers.