|

|

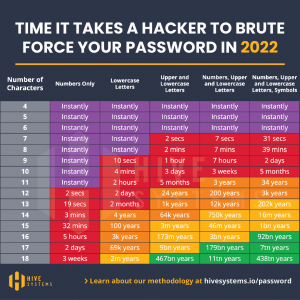

How long do you think it would take a hacker to crack your current passwords?

On average, it takes a hacker about 2 seconds to crack an 11-character password that only uses numbers. See the attached chart that illustrates the time it takes for a hacker to brute force attack your password. A brute force attack is when cybercriminals use trial and error to guess your details. Cybercriminals currently use sophisticated software that can run thousands of password combinations in a minute, but their technology and resources are only getting stronger.

A general rule is that your password should be at least 11 characters, utilizing both numbers as well as upper and lowercase letters. That combination will take hackers 41 years to crack. Regardless of the possible variations, the shorter your password, the easier it is to crack. Check out how long it will take a hacker to crack your password at https://www.security.org/how-secure-is-my-password/.

Lastly, simplify and secure your accounts by using a password manager that creates and stores all your passwords for you.

Strengthen your password security with the following tips:

Estate planning consultants for high net worth families know that ensuring your financial assets are managed according to your wishes is crucial. At Trilogy Financial, we understand the importance of creating a comprehensive estate plan that addresses your unique needs and goals. Here are the critical elements of an effective estate plan to help you secure your financial future.

A will is the cornerstone of any estate plan. This legal document outlines how you want your assets distributed and names an executor to oversee the process. A will can also designate guardians for minor children, ensuring their care and well-being. Without a will, your estate may undergo a lengthy and costly probate process, and your wishes may not be honored.

A letter of intent is a personal document that complements your will. While it is not legally binding, it can provide clarity and guidance to your executor and loved ones about your wishes. This letter can include details about asset distribution, heirlooms, and even funeral arrangements. Updating your letter of intent regularly ensures that it reflects your current wishes.

A power of attorney document allows you to appoint someone you trust to handle your financial and legal affairs if you become incapacitated. This person, often a family member or close friend, can manage your assets, pay bills, and make important decisions on your behalf. Understanding your state’s specific regulations can help you make informed decisions about this designation.

Health care directives are essential for addressing your medical needs in emergencies. Key documents include:

Subsequent marriages add complexity to estate planning. Consider the following:

If you have minor children, naming guardians in your estate plan is vital. This ensures that someone you trust will care for your children if you are unable to do so. Consider naming a backup guardian as an additional safeguard.

Trusts offer a flexible and private way to manage and distribute your assets. Benefits of trusts include:

Multi-generational wealth planning is essential for ensuring that your financial legacy benefits future generations. This involves creating strategies that protect and grow your assets while considering the needs of your children and grandchildren.

A trust fund manager plays a critical role in managing and distributing your assets according to your wishes. This professional ensures that the trust operates smoothly and that beneficiaries receive their designated assets without delays or legal complications.

Advanced estate planning strategies are designed to address the unique needs of high-net-worth individuals. These strategies may include setting up complex trusts, charitable giving, and tax optimization techniques to preserve and grow your wealth.

Philanthropic financial planning allows you to support causes you care about while benefiting from potential tax advantages. Discovering philanthropic financial planning opportunities can help you make a positive impact while strategically managing your estate.

Creating a comprehensive estate plan involves careful consideration of various legal documents and strategies. At Trilogy Financial, we specialize in estate planning for high net worth families and individuals, providing tailored solutions to meet your unique needs.

Our team of estate planning lawyers for high net worth families and high net worth estate planning attorneys are here to guide you through every step of the process. If you have questions or need assistance, please reach out to us. We are here to help.

If you're ready to elevate your financial planning with our professional team, we invite you to schedule a meeting with us. At Trilogy Financial Services, our advisors in Corona are dedicated to crafting personalized financial strategies that align with your unique goals. Don't wait to start your journey towards financial success:

Schedule a No-Strings-Attached Portfolio Review today and embark on a path to financial success guided by professional advisors. For more information and to schedule your consultation, visit www.trilogyfs.com/yourmoneyamplified. With the right knowledge and professional guidance, the journey of investing becomes an exciting venture towards achieving financial security and growth. This way, you're not just dreaming of an ideal retirement but actively working towards making it a reality.